Cerise

Well-Known Member

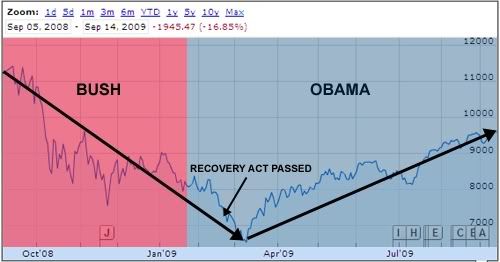

LOL! Of course you would rely on a chart from Pelosi's office.

Since the Democrats have been in charge of both the senate and the house, the housing market has collapsed, the banks have collapsed, Fannie and Freddie have collapsed, the auto industry has collapsed.

0bama continues to blame his inability to handle the economy on what he "inherited," and the unemployment rate that his admin promised his $3.27 stimulus package would hold down below 8% is currently at 9.5%.

The average unemployment rate under Bush was only 5.2%.

0bama and Co. have jacked it up to 9.4%

I ask again: where do the dems get their nerve?

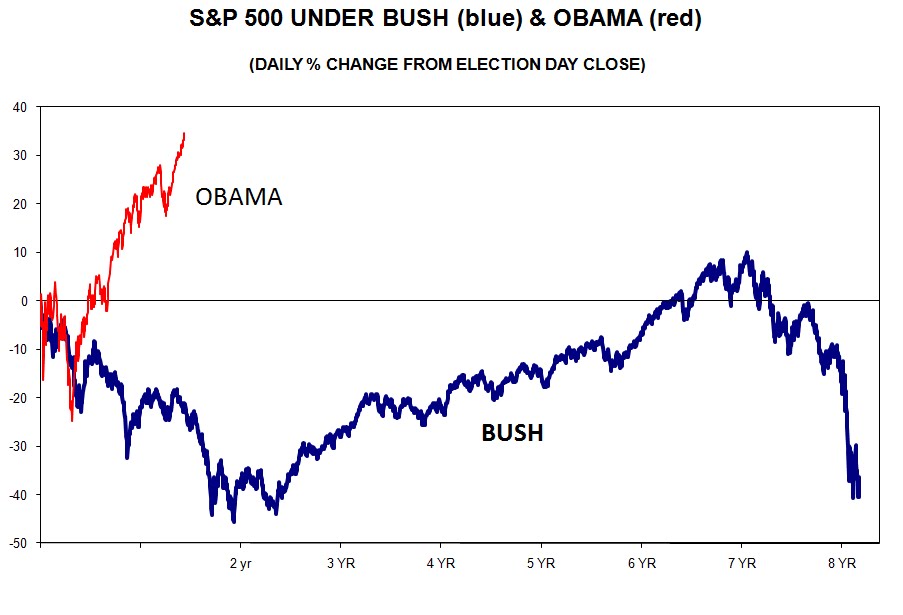

From the Dept. of Labor:

Since the Democrats have been in charge of both the senate and the house, the housing market has collapsed, the banks have collapsed, Fannie and Freddie have collapsed, the auto industry has collapsed.

0bama continues to blame his inability to handle the economy on what he "inherited," and the unemployment rate that his admin promised his $3.27 stimulus package would hold down below 8% is currently at 9.5%.

The average unemployment rate under Bush was only 5.2%.

0bama and Co. have jacked it up to 9.4%

I ask again: where do the dems get their nerve?

From the Dept. of Labor: