ResearchMonkey

Well-Known Member

Unprecedented

Analysis: Obama Remains More Popular than Reagan

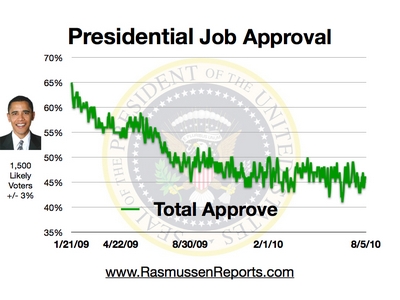

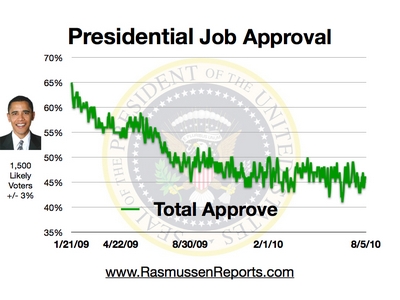

One of the dirty little secrets about presidents and approval ratings is that more often than not the numbers are governed by pocketbook politics. Both Barack Obama and Ronald Reagan inherited recessions early in their terms, and interestingly, Obama is has a higher approval rating that Reagan at the same point during their first terms. Obama is actually stronger than Reagan was right now.

In order to keep the numbers consistent, all data comes from Gallup. First some broad overall statistics, Ronald Reagan’s overall approval rating averaged for both of his terms was 52.8%, while Obama’s average for his entire term is 55%. During Reagan’s first term, his approval rating average was 50.3%, in comparison to Obama’s 54%. As you can see, Obama is slightly ahead of Reagan at this point, but they are both in the same range.

Why Reagan and Obama make for a good comparison is that the case can be made that they both inherited bad economies when they came into office. The Reagan Recession lasted from July 1981-November 1982, while Obama has been dealing with a recession that he inherited since taking office in January 2009 through the present day.

In the case of Ronald Reagan, the recession ate away at his approval ratings, which were only boosted by a 68% sympathy approval rating after he was shot on March 30, 1981. For his first year in office, Reagan’s approval rating was 57%, but the recession took its toll in the second year and his approval rating dipped to 43% after his second year. He hit his all time low approval rating in January 1983 at 35%, and for his third year his approval rating was 45%. Reagan’s approval rating did not start to turn until late into his third year.

During the recession Reagan posted approval ratings of 42%, 41% and then September-December Reagan’s approval rating did not budge from the 41%-43% range. It got even worse for Reagan in 1983, as he opened 1983 at 35% and did not even reach 50% job approval until November of that year. The situation for Obama is similar. After one year in office Ronald Reagan’s approval rating was 47%, and Barack Obama’s was 49%. Obama’s yearly average in 2010 so far is 49%. Since November of 2009, Obama’s approval rating has ranged from 47%-51%. His lowest approval rating was 47% in April 2010.

The good news for Obama is that he is already in better shape than Reagan was at this point. The bad news is that if history is any indication, Democrats should be preparing to lose some seats in the midterm election this fall. Ronald Reagan’s Republicans lost a net 27 House seats to the Democrats in 1982, and the historical midterm average defeat for the president’s party in midterms is 28 House seats. Much like Reagan, once the economy improves in time for his reelection bid, you can expect Obama approval ratings to take off.

Current Republicans don’t like to bring this up, but recessions tend to make a president of either party very unpopular. It happened to Ronald Reagan, and it has happened to Barack Obama. The economy is simply a part of the cycle of politics. The GOP is out there selling the economy as the end of Obama, when the truth is that Obama, much like Reagan, will rebound to his previous popularity levels once the economy recovers. Obama is no more in trouble than Ronald Reagan was, but this is the part of the story that Republicans would rather not think about, because we all remember what happened to Walter Mondale in 1984. It is very possible that Sarah Palin or Mitt Romney will be set up to be the 21st Century Mondale.

As long as we selectively leave the president out.

spike, our Consitution says the Congress pays the bills. I don't give a shit who writes the budget...it's Congress who holds the purse.

"The person who writes the budget controls how money is spent"

Well then who ever that motherfucker is

he should be shot!

tastes great Less filing

3-5% gain in unemplyment before March 2011.